From paying employees to managing taxes, processing your payroll can be a real headache without automated solutions — not to mention both time-consuming and error-prone. Indeed, a staggering 19 percent of U.K. workers are often paid late or incorrectly on a regular basis1.

That might sound daunting but manual payroll can be a cost-effective solution for many smaller businesses. So, let’s take a closer look at exactly what manual payroll entails and find out how you can run your payroll without payroll software.

Table of Contents

Understanding payroll essentials

Running payroll is non-negotiable for any business owner. After all, you’re legally responsible for withholding the correct amount of income tax and contributions from employee pay. But before we can run, we need to walk. So, let’s quickly brush up on the payroll essentials.

The payroll process begins by calculating how much your employees have earned based on various information, including their salary and hours worked. You then need to make certain payroll deductions, including income tax, National Insurance, etc. and send these to HM Revenue & Customs (HMRC). Lastly, you’ll also need to produce payslips and keep detailed records.

Top tip: the U.K. Government provides a lot of useful information on running payroll.

Payroll options

There are three basic approaches to payroll. However, you can combine them for a more balanced, hybrid approach. Here are your three payroll options:

- Manual payroll: running payroll manually can be cost-effective but also time-consuming and prone to human error.

- Payroll software: payroll solutions automate the process to help minimise errors and save time.

- Outsourcing: payroll service providers can handle all your payroll tasks for a more hands-off approach.

Setting up payroll

Before you can get your chosen payroll system up and running, there are a couple of tasks you need to complete, including:

Registering as an employer

First, you need to let HMRC when you start employing staff. Although the process is straightforward, keep in mind that it can take up to 15 days to get your PAYE reference number and login. You can start the application up to eight weeks before you pay anyone for the first time.

Deciding on pay dates

Next, you need to decide when you’ll pay your employees. Most companies pay their employees monthly, typically on or around the end of the month. Don’t forget that under the Employment Rights Act 1996 you must pay your employees on your agreed payday.

Checking your responsibilities

Lastly, you need to check automatic enrolment for workplace pensions. Under the Pensions Act 2008, all employers must enrol eligible staff in a pension scheme and contribute. Your legal duties start when you hire your first staff member, so it’s important to understand your obligations, including completing a declaration of compliance.

You can find more information about setting up payroll on the U.K. Government’s website. Bear in mind that HMRC advises payroll software if you decide to run payroll yourself.

Manual payroll calculation process

Although manual payroll can save you the cost of payroll software, it’s important to remember that it requires meticulous attention to detail and in-depth knowledge of relevant laws and regulations. What’s more, it’s often difficult to scale.

Nevertheless, manually calculating payroll can be a practical approach for both small businesses and startups operating on a tight budget. For example, if your business has fewer than 10 employees, manual payroll can be a viable and cost-effective solution.

Here are seven steps to calculate your payroll manually:

Step 1: Collect employee data

The first step in the manual payroll process is to gather information from your employees, including:

Personal information:

- Forename(s) and surname

- Date of birth

- Address

- Gender

- National Insurance Number (NINO)

- Tax code (on the employee’s P45)

Employment details

- Hours worked (including regular hours and overtime)

- Contracted salary

- Type of employment (full-time, part-time, freelance, etc.)

Top tip: you can simplify this process by creating a payroll ID system. Simply assign a unique payroll ID to each employee to help you better track your records and protect employee privacy.

Keep in mind that accuracy is vital when collecting employee information. Manual payroll systems depend on proper record-keeping, as correct and up-to-date information helps you avoid any issues with tax returns or payments.

Step 2: Calculate gross pay

The next step is to work out how much each employee has earned based on their hourly rate or agreed salary, including other income sources such as bonuses and commissions. Bear in mind that gross pay will be different to calculate depending on employment type. For example:

- For hourly employees, you can calculate gross pay by multiplying the hourly rate by the total number of hours worked in the pay period.

- For salaried employees, gross pay is simply the agreed amount they earn in each pay period (fixed salary)

Step 3: Calculate deductions

Once you’ve worked out gross income, it’s time to tackle deductions. Deductions are a critical part of payroll and include income tax, National Insurance contributions, pension contributions and student loan repayments.

Here’s a quick overview of what you need to know for each type of deduction:

- Income tax: you’ll need each employee’s tax code and the latest tax rates (or tax calculator) and thresholds from HMRC to calculate the correct amount of income tax to withhold from your employees’ pay.

- National Insurance: National Insurance Contributions (NICs) are based on gross pay and employment type. You’ll need each employee’s National Insurance category letter to get started. Remember to calculate employee and employer contributions separately.

- Pension contributions: you should deduct any pension contributions after National Insurance but before tax. You’ll also need to pay any employer contributions into your employee’s pension.

- Student loan repayment: you can work out how much an employee needs to pay — and therefore how much you need to deduct — based on your employee’s student loan plan. It’s typically between six to nine percent of their income.

- Voluntary deductions: these deductions are agreed between employee and employer. Charitable contributions are the most common. For example, employees can donate to charity directly from their pay before tax is deducted using Payroll Giving.

- Union membership: any employees who are members of a trade union may have their membership fee deducted directly from their salary. This typically also needs to be agreed between the employee and employer.

Step 4: Calculate net pay

Now that you’ve worked out both gross pay and deductions, calculating net pay is easy. Simply subtract all deductions from gross pay. If you’re unsure you can check your payroll calculations using various calculators and tax tables provided by the government.

Step 5: Send out payslips

Once you’ve worked out your employees’ take-home pay, it’s time to send out payslips. In the U.K., payslips must contain certain information, including pay before deductions (gross pay) hours worked, pay after deductions (net pay) and the total amount of deductions withheld.

Although not mandatory, you can also include National Insurance numbers and tax codes on employee payslips. Just remember that payslips must be provided to employees on or before their payday — whether as physical or digital copies.

Step 6: Report to HMRC

Once you’ve made all your calculations and deductions, you need to inform HMRC of what you’ve paid your employees and what you’ve deducted. Send a Full Payment Submission (FPS) before or on your employees’ payday, making sure to include all employees.

After you’ve sent the FPS, you can view what you owe HMRC in tax and National Insurance and claim reductions. Note that you must pay the balance by the 22nd of the tax month. However, you can also put right any errors with a corrected FPS and report additional information, for example, new employees or departures.

Step 7: Keep records

Keeping records of each employee’s pay is essential when running payroll. Not only does it help you stay compliant and avoid hefty fines, but it also makes your tax returns easier and budgeting more accurate. We recommend documenting every detail, including dates, employee information, gross pay, deductions, etc.

It’s also important to note that there are certain legal requirements when it comes to maintaining personal information, tax records and National Insurance contributions for employees. For example, you must keep PAYE records for three tax years and auto-enrolment records for at least six years.

The benefits of payroll software

The steps detailed above will help you manage your payroll without software. However, as your business grows investing in reliable payroll solutions can save time and money whilst also reducing the risk of both errors and non-compliance.

For small businesses, HMRC’s free basic PAYE Tools are a good starting point, but they may not cover all your needs as your business expands. As such, payroll software is essential to help small and medium-sized enterprises, as well as large businesses, run their payroll smoothly.

Here are three ways payroll software can save time and money for your business:

Automation

Payroll software can significantly reduce the time your team spends on manual tasks by, for example, calculating deductions. Automation also helps minimise human error for a more accurate and consistent payroll process.

Integration

You can connect payroll software with other systems such as accounting software. Integration not only keeps data accurate and up to date across all financial systems, but it also saves time — no more manual data entry or time-consuming updates.

Security

Payroll solutions can help improve your data security. With high-level encryption and security protocols, payroll software helps keep sensitive employee information — including personal and bank account details — safe and sound.

Manual payroll vs payroll software

Manual payroll is often complex and time-consuming, with many companies often struggling to maintain accurate records and comply with legal standards. It’s no surprise then that HMRC now requires employers to get payroll software that reports PAYE information online.

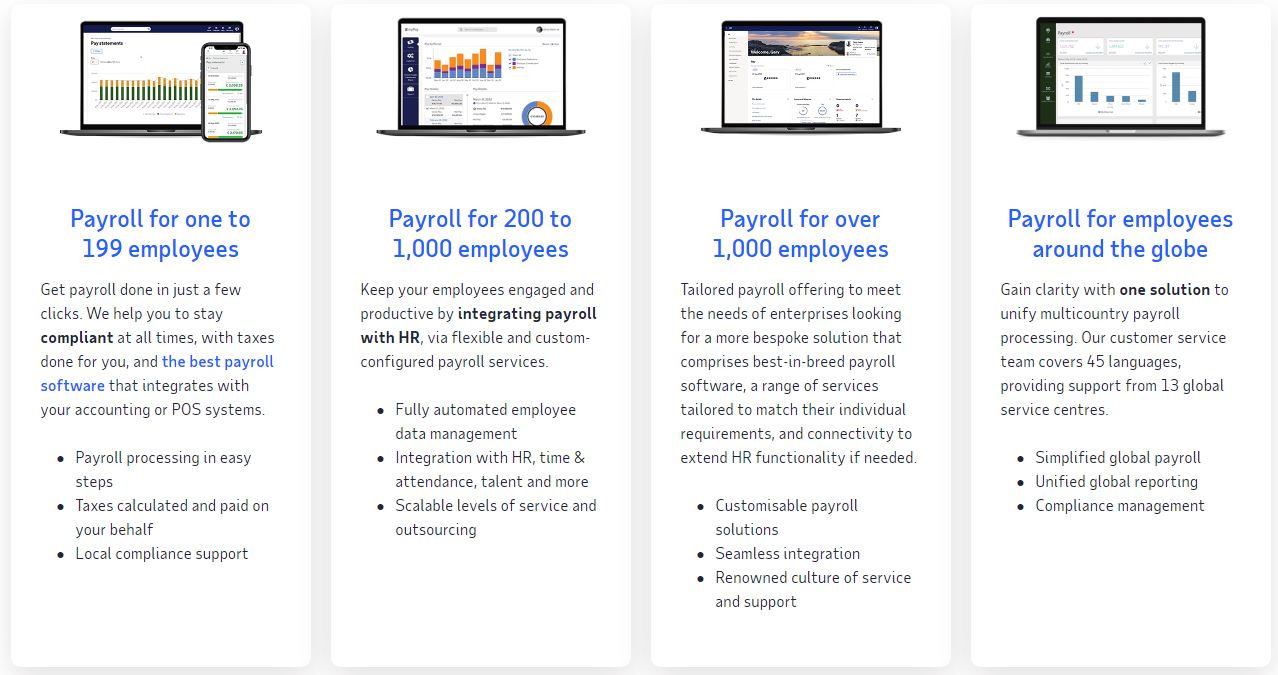

ADP provides intuitive, scalable and HMRC-recognised payroll solutions to meet the unique needs of your business. Find out how our payroll software can take your payroll process to the next level.

1 ADP People at Work 2022: A Global Workforce View