Small Business Payroll: Accurate, Flexible, Affordable

- Tailored for UK Small Businesses

- Only pay for what you need

- Self-serve or fully managed services

- HMRC approved

Small business payroll is our speciality

More than half a million small businesses, from startups to single employees to growing companies, trust us with their payroll. We understand that every business is unique, which is why we’ve built payroll programs for small businesses to help you:

- Focus on your business, not payroll

- Run payroll accurately and easily

- Navigate the complexities of compliance

- Act on advice for year-end HMRC tax returns

- Receive quarterly and annual reports

- Access payroll experts when needed

The Benefits of ADP Payroll Services for Small Business in the UK

Get startedTrusted Payroll Services for Small Businesses

As payroll experts for over 75 years, we understand small businesses and the unique nature of individual payroll runs. We’ve built small business payroll services that take the pressure off business owners like you, so you can get on with what you do best.

Join the more than half a million small businesses who already trust us with their payroll services. Our small business services are affordable, save you time and help you sleep easier, whether you have one employee or many.

Get a free quoteWhat people say about our small-business payroll services

Support is the best, the service team is responsive, it does exactly what it says on the tin.

Jalen Davis,

Management Accountant

Simba

In choosing our solution we wanted to go with an organisation that was credible. One in six people pay through ADP so it's a massive organisation. But you don't feel like you're dealing with a huge organisation. You feel like you're dealing with a local partner.

Lee McQueen,

Managing Director

Raw Talent Academy

Having had experience with ADP through our parent company, it was a natural progression for us to move forward with ADP’s payroll, and time and attendance systems.

Christine Stubbs,

HR Advisor

Holophane Europe Ltd

How does small business payroll software work?

You can either choose our payroll processing service or managed service.

Payroll processing service

We host the processing platform while you manage data entry and validate the data output. ADP payroll cloud software is agile, flexible and robust. Your payroll automatically calculates employees’ PAYE, payroll taxes and retirement contributions, and issues payslips. You stay compliant with HMRC, payroll regulations and GDPR, while receiving quarterly and annual reports.

Payroll managed service

Our team of ADP experts manage the majority of your small-business payroll processing by reducing the need for your full back-office payroll department. You’ll have dedicated ADP specialists available for you when needed, handling payroll application updates and upgrades along with ensuring compliance of payroll software. We’ll also control the quality of your payroll and handle mandatory reports.

Awards & Recognition

Payroll product recommendations for small businesses

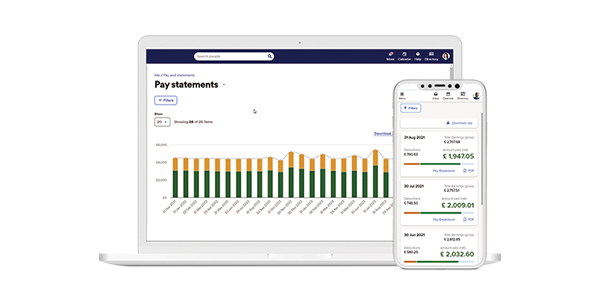

ADP® iHCM

ADP® iHCM is a cloud-based platform that simplifies payroll and HR management in one scalable, compliant solution. It’s accessible from any device. Easy to implement and cost efficient, now there's a single system to manage your company's payroll and employee time, training, talent and recruitment management.

Find out more

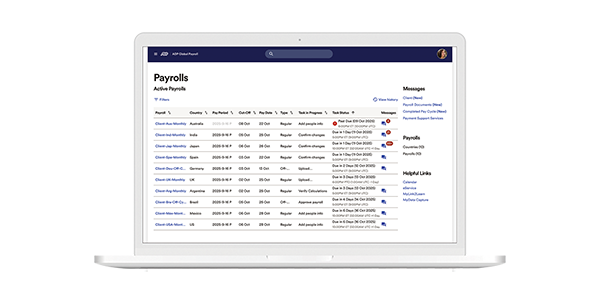

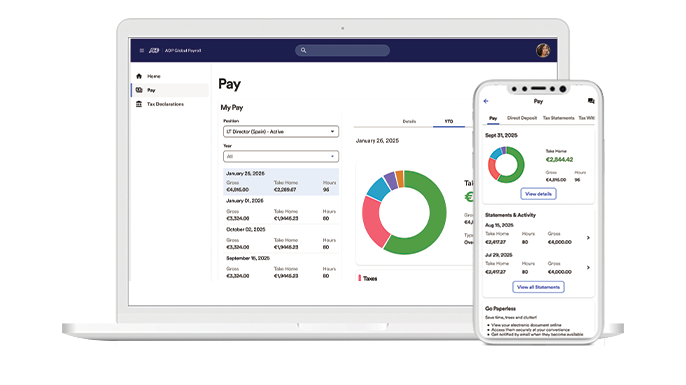

ADP® Global Payroll

- ADP Global Payroll makes it easy for small businesses to manage payroll across several countries with one simple, reliable system.

- It centralizes employee data, streamlines processes, and ensures accuracy and compliance, so you can focus on growing your business.

- With built-in integrations and local expertise, ADP helps you stay compliant and efficient from the very first country you expand into.

Find out more

Enquire Today

Call us at: 0800 1707 677

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.

FAQs about small business payroll

How do small businesses manage payroll?

If you’re a small business, payroll is probably one of your least favourite activities. It can be complex, time-consuming, prone to manual errors – not to mention keeping up with compliance regulations. The smart, cost-effective choice is to switch to a trusted payroll services provider who’ll run your payroll accurately and ensure you meet your compliance obligations. Leaving you time to focus on running your business.

How does payroll work for a small business?

Small-business payroll solutions are usually customisable and scalable, paid per employee per month. This allows you the flexibility to adapt as your business needs change. At ADP we offer a range of payroll services. Whichever model you choose, outsourcing your payroll ensures that your people are paid accurately and on time, while protecting your business from liabilities.

How much does it cost for a SME to outsource payroll?

Outsourcing your payroll to a provider like ADP can save your small company valuable money and time – both in short supply when wearing multiple business hats. The actual costs will vary depending on your business size, specific requirements, and whether you need entry-level payroll or a fully managed payroll solution. Gone are the costs of setting up, training and running an internal payroll department, while contending with administration and compliance regulations.

Why choose ADP for small business payroll?

Half a million small businesses like yours trust ADP to take care of their payroll services. Perhaps it’s because we have over 70 years of experience in payroll. Or maybe because our small business payroll solutions are affordable, saving you time and complexity, and can be scaled up or down to meet the changing needs of your business.

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.