Global payroll services

Keep international teams connected with a single, engaging user experience and some ADP gold dust: our 7,000+ global payroll experts advising people in 140+ countries.

The benefits of ADP global payroll services

Sometimes bigger is better. Our global payroll solutions are designed for large companies like yours.

Building on years of international payroll best practices, our software offers a top five security programme1 and certified system integration, for pre-built connectivity with payroll and popular HCM systems. For trusted, connected global payroll wherever you are.

Talk to an expert

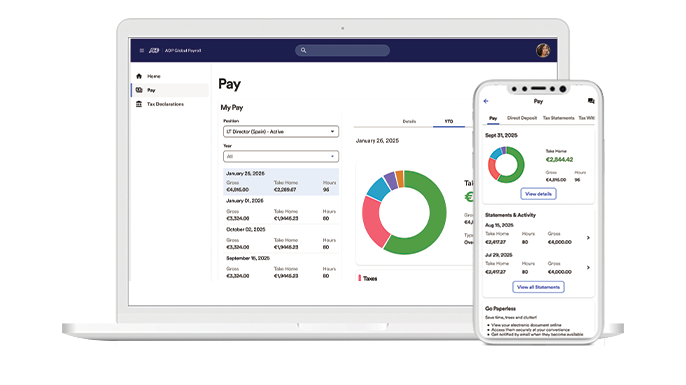

One unified platform for your global team

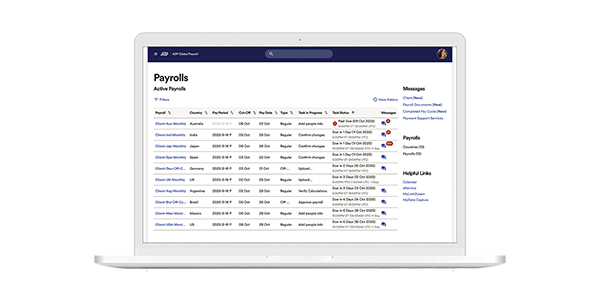

ADP® Global Payroll

MULTI-COUNTRY PAYROLL PLATFORM REGARDLESS OF LOCATION SIZE

- Designed to manage global payroll for organizations operating across multiple countries

- ADP Global Payroll helps businesses run complex payroll more easily.

- It delivers compliant payroll through a scalable approach that supports different levels of complexity, while providing clear visibility and access to reporting and analytics.

- Built with strong compliance, data privacy, and safety features, ADP Global Payroll supports consistent payroll operations across countries.

One scalable solution for multicountry payroll

Bring the world to you, however complex it gets. ADP global pay solutions are underpinned by innovative cloud-based technology that offers a single, scalable system which grows with you. Our connected international payroll keeps you up to date with thousands worldwide compliance changes every year, all enhanced by our specialist regional and local payroll experts.

Awards and recognition

As leaders in international payroll services and human capital management (HCM), we make it easy for you to choose a trusted provider. ADP is ranked as leader in Global Payroll across multiple industry analyst reports.

Plus, a commissioned study conducted by Forrester Consulting on behalf of ADP3 found that large, international organisations with ADP Global Payroll saw the following benefits:

Return on investment

161%

Avoidance of compliance costs

$6.4M

Total payroll process efficiency gain (large and small countries)

$3.3M

Direct cost avoidance of legacy systems

$2.2M

So you can relax in the knowledge that we’re here to support you on your journey to unlock the power of payroll.

Stay compliant with ADP’s global payroll services

ADP is trusted the world over – and don’t just take out word for it. Our proven global payroll services identify an average 3-year compliance cost avoidance of $6.4 million.1

That’s why 90% of Fortune 100 companies outsource compliance management to us, safely paying 42+ million employees. Our experts are constantly monitoring the globe for payroll-related legislative changes. Ready to seamlessly slot the latest rules and regs into your international payroll function.

We’re a global data protection pioneer. One of the first to receive approval from the European Union Data Protection Authorities to roll out processor and controller Binding Corporate Rules (BCRs). ADP is GDPR compliant and certified to issue SOC 1 and 2 reports, ISO 9001 and 27001 certifications, Sarbanes-Oxley, and Payment Card Industry (PCI) Data Security Standards.

Why our clients choose ADP global payroll services

Client: Mondelez

Industry: Food and drink

Problem: Restoring cybersecurity and trust after a global malware attack.

Solution: Mondelez and ADP partnered on business continuity planning to get every country up and running again, and data secure.

Result: Working together, within 3 months all regions were stable and scaled up where needed.

“We decided to go with ADP because no other partner had us in mind. We are the same team, just with different email addresses.”

Volker Schrank

Senior Director, Employee Experience and HR Technology

Mondelez International

Client: Raytheon Technologies

Industry: Aerospace and defence

Problem: Current payroll and HR services didn’t chime with their innovative company culture.

Solution: Implementation of ADP Global Payroll.

Result: ADP’s end-to-end, low-code technology reduced payroll footprint, mitigating $20 million of tax exposure.

“Innovation is part of our DNA. It’s how we define success as an organisation.”

Marc Fafard

Executive Director of Payroll

Raytheon Technologies

Client: Four Seasons

Industry: Hotel and resorts

Problem: Needed flexible and reliable payroll for properties across different countries.

Solution: ADP gave the Four Seasons white-glove service, understanding their underlying business model and each resort’s specific jurisdiction needs.

Result: Four Seasons successfully expanded their payroll beyond the US, venturing into UK, France Bahamas and St Kitts & Nevis.

"Our partnership with ADP reflects our common approach. Caring about people, treating people right and fairly, runs deeply in both our DNA."

Robert Dunigan

Senior Vice President, Operations Finance

Four Seasons

Streamline your international payroll

No more herding cats, please. No wonder 76% of organisations are thinking of outsourcing some payroll processes to support teams across the world.2

All countries have different requirements, which can be unwieldy and complicated. HR leaders are looking to international payroll companies like ADP to streamline payroll. Cloud-based global pay solutions offer up-to-the-minute responsiveness, standardising practice between disparate regions while experts keep local compliance at the fore.

How our global business payroll solutions work

Rolling out global payroll across multiple countries works as follows:

1. Agents work with you to discuss your current multicountry structure and level of functionality needed.

2. Cloud-based software links with existing software to securely import employee data.

3. Payroll technology takes over simple admin tasks like pay runs, payslips and annual leave management.

4. Global payroll services calculate, pay and report country-specific tax.

5. Platform gives HR teams access to a wide range of workforce-related reports.

Don’t forget, throughout the process ADP experts are available to liaise and troubleshoot on any international payroll issues.

Schedule a customised demo

Call us at: 0800 1707 677

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.

FAQs

Your ADP global payroll questions answered

What are global payroll services?

A one-stop shop for multinational HR teams. International payroll software looks after admin tasks like pay runs, tax calculations and legal compliance reporting across different countries. Global payroll services offer a single, cloud-based system of record which centralises reporting wherever you company does its business. All this joined-up data is at your fingertips for ongoing insight and future planning.

How to choose a global payroll provider?

When choosing international payroll providers, ask the right questions. Do they use best-in-class, cloud-based technology? Are local advisers available across multiple countries when needed? Will your teams be able to access the latest multicountry payroll data in a single view? Do they provide compliance experts to update you on regulatory changes? If these are all aligned with your business, then you’re good to go.

How much does an international payroll provider cost?

This all depends on what you’re after. Good international payroll providers should be happy to adapt to your specific multicountry organisational requirements, clearly costing this throughout. With ADP, prices are fixed according to employee numbers so will scale with you.

Which companies use ADP for payroll?

Every shape and size multinational is welcome. For over 75 years, we’ve been helping companies large and small with their global payroll. A few international superstars include: Commvault, Dell, Intuit, London Stock Exchange Group (LSEG) and Michelin

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.

Resources & Insights

PODCAST

What you'll need to know about running payroll in different countries.

PODCAST

What you'll need to know about running payroll in different countries.

guidebook

What’s the potential of your payroll organisation in 2026?

insight

A guide to global payroll management and best practices

2 ADP, The potential of payroll in 2025: Global payroll survey

3 Forrester Consulting, Total Economic Impact™ of ADP Global Payroll, October 2020.