Payroll services to power your business

Payroll processing can be complex and time-consuming for any business. ADP can streamline your payroll effectively and compliantly. Whether you're searching for comprehensive payroll services, evaluating different payroll providers, or simply looking for the best companies for payroll, trust ADP for accurate and efficient solutions.

Payroll services built for your organisation’s size

Most payroll rules revolve around business finances. So, accuracy is vitally important, in both adherence to the most up-to-date letter of the law but also, the very payroll calculations themselves. Today, the best way to ensure all this is working effectively is by using a comprehensive payroll software offering like those from ADP. Streamlining such payroll processes is a no-brainer for any organisation—you meet your legal requirements, and everything ends up adding up nicely.

Payroll for one to 199 employees

Get payroll done in just a few clicks. We help you to stay compliant at all times, with taxes done for you, and the best payroll software that integrates with your accounting or POS systems.

- Payroll processing in easy steps

- Taxes calculated and paid on your behalf

- Local compliance support

Payroll for 200 to 1,000 employees

Keep your employees engaged and productive by integrating payroll with HR, via flexible and custom-configured payroll services.

- Fully automated employee data management

- Integration with HR, time & attendance, talent and more

- Scalable levels of service and outsourcing

Payroll for over 1,000 employees

Tailored payroll offering to meet the needs of enterprises looking for a more bespoke solution that comprises best-in-breed payroll software, a range of services tailored to match their individual requirements, and connectivity to extend HR functionality if needed.

- Customisable payroll solutions

- Seamless integration

- Renowned culture of service and support

Payroll for employees around the globe

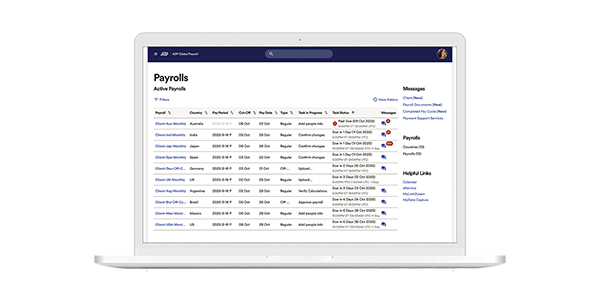

Gain clarity with one solution to unify multicountry payroll processing. Our customer service team covers 45 languages, providing support from 13 global service centres.

- Simplified global payroll

- Unified global reporting

- Compliance management

The benefits of ADP payroll services

Payroll and providing accurate payroll software is our specialty. Our certified payroll professionals are well-versed in the latest HMRC regulations and are here to provide expert support and guidance every step of the way. With ADP, you can rest assured that your payroll processing is always accurate, compliant, and stress-free.

ADP payroll services help you to:

Overcome the complexity and risk of sourcing, managing and delivering payroll services.

Unify and standardise your payroll processes into a best-in-class model that helps reduce HR administrative costs.

Anticipate changes in laws and regulations, while managing differences in time zones, currency and language.

Benefit from a single view of workforce data for reporting and analytics, improving fact-based decisions.

How do ADP payroll services work?

ADP payroll services are comprehensive, offering partially or fully managed payroll administration with varying levels of service to best meet your needs. From processing payslips, to issuing P60s and helping you keep compliant with HMRC regulations, ADP payroll services simplify the administrative tasks of managing payroll.

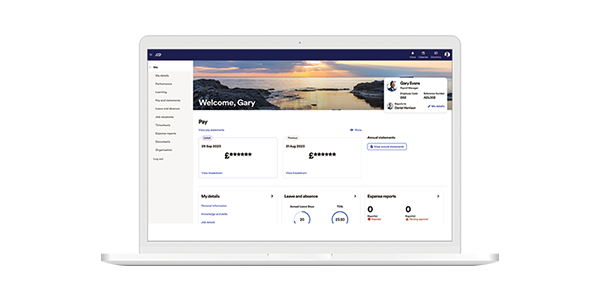

Our platform lets you access a wide range of workforce-related reporting services, delivering reports from headcount to labour cost analysis, across geographies and employee populations. ADP offers our own unified HCM solutions built on top of ADP payroll. These are flexible enough to integrate easily with third-party HCM systems.

Why should I choose ADP payroll services?

ADP provides flexible payroll services that help to simplify payroll, so you can scale up or down depending on your business needs. We manage the complexities and day-to-day tasks of payroll, so you can focus on running your business. By ensuring greater accuracy and seamless integration, our cloud-based technology also delivers insights to help you make more informed decisions.

Our extensive network of experts enables us to provide both local or global coverage, depending on where your business is based. So you can now meet those UK payroll expectations effortlessly. As a payroll services provider, we offer:

- Payroll processing that’s faster and easier — locally and globally

- Online employee and manager self-service

- Certified, experienced payroll professionals

- Simple integration with your existing business software, time tracking, HR systems and enterprise resource planning (ERP)

Why our clients choose ADP for payroll services

Only 26% of businesses rate the performance of their current payroll provider as good or very good, according to the 2019 EY Global Payroll Survey. Yet, when you work with the right payroll service provider, you can relax knowing that you’ve lowered your risk - your employees will be paid accurately and tax liabilities met on time.

ADP offers more options than any other payroll services provider. We’ve been living and breathing payroll for 75 years, and over 1,000,000 customers globally trust us to deliver and support modernised payroll processes. With 45 support centres in 140 countries, we’re here with you on your journey to unlock the power of payroll.

It’s a big achievement with many teams and many people, but an achievement that I would say that ADP and us are very proud of. Our CEO is taking this example as the first milestone of our digital transformation and our simplification journey.

Karine Casanova Munnik,

VP, HR Services

Philips Domestic Appliances

Errors are generally inevitable whenever a new solution is implemented. However, with ADP it was not like that at all. With ADP, the whole process was very smooth and the new declaration reports were implemented without any issues or mistakes.

Merel Lommers,

Human Resources Business Partner at Starbucks Netherlands

Starbucks

We went with ADP. It is the market leader in terms of multi-country payroll operations and has a highly scalable solution so can expand and adapt to the needs of our business.

Charlotte O’Driscoll,

Global Payroll and People Projects Director

Sage

What we can do with ADP is really to build a modern, efficient, flexible way to provide HR admin and payroll services to the hotels.

Fabrice Debilly,

VP Talent & Culture Digital Services

Accor

Employees now feel more in control of their own information. As a result, the system has been extremely well received.

Minne Polhuis,

Delivery Manager, Strategic Projects

ERESM

It’s very reassuring to have the expert team at ADP to support us when needed. They’re always extremely responsive and willing to help, no matter what the request.

Uma Ari,

HR Business Partner

ArcelorMittal

Join the 1,000,000+ businesses that trust ADP

Get a free quoteLet's find the perfect solution for your business

Call us at: 0800 1707 677

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.

Payroll Services

FAQs

What do payroll services do?

Payroll providers carry out a range of services for companies who don’t wish to run an in-house payroll. These include calculating employees’ pay, making any necessary deductions such as retirement contributions, keeping accurate records and filing taxes with HMRC.

What are payroll managed services?

If you choose as a business to hand over every payroll process to a trusted outsourced provider like ADP, these are known as payroll managed services. You can also outsource your human resources information system (HRIS), so that your HR and payroll functions are unified for a complete view of your business data. This transparency can benefit your operational efficiency and strategic decision-making as a result.

Who needs payroll services?

Is your business struggling with running in-house payroll? Can’t afford the time or expense to recruit, train and retain accounting or HR professionals? You could benefit from outsourced payroll services. You’ll save the costs of an in-house department, and avoid the complexity of reporting to Government authorities. Plus, say goodbye to manual errors and potential fines for missing compliance deadlines.

Why ask ADP to process payroll for me?

Using ADP to manage your payroll gives you peace of mind, while freeing up time for you and your staff. Using our online payroll system syncs your payroll data with other solutions, like time tracking, benefits and compliance software, saving you money and noncompliance penalties. We take your data protection extremely seriously, which is why we add an extra level of governance to your employee data.

What are the different payroll services provided by ADP?

ADP offers a processing service with a hosted platform for our clients to manage data entry; or a managed service offering online payroll services, solutions and software for businesses of all sizes. Our managed service offers two forms of payments, via BACs or a payroll disbursement service where we pay employees and HMRC direct. Our payroll services can integrate with time and attendance tracking. Plus, we also automatically calculate deductions for taxes and retirement contributions, providing expert support to help make sure you stay compliant with all applicable rules and regulations.

Will ADP payroll services do my taxes for me?

ADP helps companies manage payroll taxes by automating deductions from employee wages and making sure the right amount of money is delivered to the government, based on the latest payroll tax rules and regulations.

Will ADP payroll services integrate with my current software?

Yes. You can also start with ADP payroll and then add on other ADP services such as time and attendance, HR, talent, data and more as you need them.

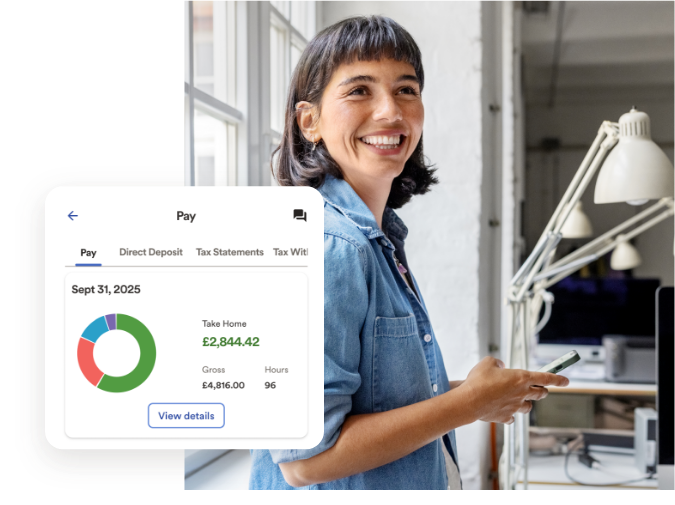

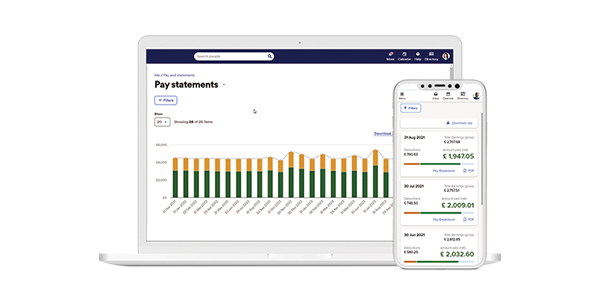

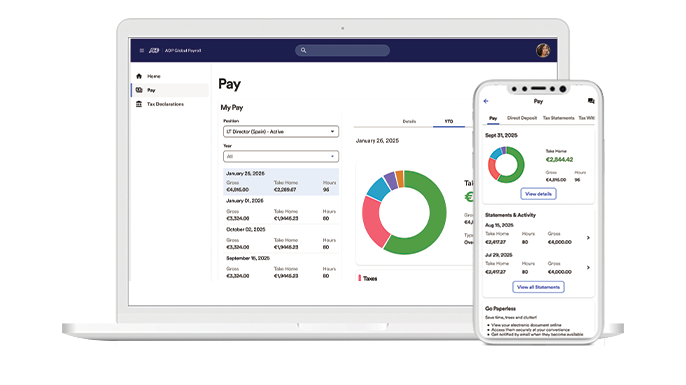

Does ADP have online payroll tools or a mobile app for employees?

ADP mobile solutions give employees access to their payroll information and benefits, no matter where they are. Employees can complete a variety of tasks, such as view their payslips, manage their time and attendance, and enter time-off requests.

Latest articles & insights

guidebook

What’s the potential of your payroll organisation in 2026?

insight

Why you need one global payroll services provider

FAQ

What is payroll software?

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.