SaaS Payroll for large and small businesses

What does SaaS payroll mean?

Software as a Service (SaaS) payroll describes software that processes payroll via online access and use - unlike the type of software which is installed and used via a local computer or server. Organisations can use this variety of online payroll services to manage their employee wages, tax deductions, benefits, and other payroll related tasks. Often, SaaS payroll systems can offer extra features including tracking time, administration of benefits and the generating of reports.

Benefits of using a SaaS payroll service

Enhanced efficiency

A SaaS payroll solution improves efficiency by automating numerous payroll functions. From calculating wages and taxes to generating payslips and managing benefits, these services reduce the need for manual data entry and minimise the risk of human error. This automation not only saves time but also ensures accuracy, enabling fast, effortless payroll processing.

Time and cost savings

By outsourcing payroll processes to a SaaS provider, companies can free up valuable time and resources to allocate to other critical aspects of business. Instead of dedicating hours to manual payroll tasks, time can be focused on strategic initiatives, growth, and customer satisfaction. In addition, SaaS payroll services often come at a fraction of the expense of hiring and maintaining an in-house payroll team, making it a cost-effective solution for businesses of all sizes.

Compliance and security

Staying compliant with ever-changing payroll regulations is a constant challenge. Cloud-based SaaS payroll software removes this burden by keeping systems up to date with the latest legal requirements. They ensure that tax calculations, deductions, and reporting align with the relevant laws and regulations, reducing the risk of penalties and fines. Furthermore, these services prioritise data security, employing robust encryption protocols and regular backups to protect sensitive employee information.

Scalability and flexibility

As a business grows, so does the complexity of payroll requirements. SaaS payroll services offer scalability and flexibility, adapting to evolving needs. Whether a company has a handful of employees, or a large workforce spread across multiple locations, these services can accommodate payroll demands seamlessly. With user-friendly interfaces and customisable features, SaaS payroll solutions provide the agility to handle diverse payroll scenarios.

Real-time accessibility and reporting

Traditional payroll systems often require manual data retrieval and reporting, leading to delays and limited insights. SaaS payroll services provide real-time access to payroll data, empowering employers by making critical information immediately available. With comprehensive reporting features, companies can generate custom reports, analyse trends, and gain valuable insights into payroll expenses, to ultimately facilitate informed decision-making.

Case Study: Helping Sage with SaaS payroll

Founded in Newcastle, UK, in 1981, millions of SMBs - small and mid-sized businesses - across the globe are served by the payroll, finance, and HR software created by Sage and their partners. The company employs almost 12,000 people and while Sage is known for their effective payroll solutions for SMBs, as a larger organisation that’s continuing to grow, they required an external solution to match their size.

When Charlotte O’Driscoll joined Sage as Global Payroll and People Projects Director, she was given the task of setting up a cohesive global payroll strategy for the organisation. She said, “Payroll is the only function that touches every employee, every month. As such, picking the right solution is key.”

The Challenges

Sage was using 14 unconnected payroll solutions when Charlotte began her comprehensive search for a new and unified SaaS payroll.

Her specifications were to find a SaaS payroll solution that was fit for a large organisation, bringing consistency as well as control, and replacing their existing fragmented model that used numerous systems across different countries.

Charlotte was also seeking a trusted supplier that had not only expertise in global operations, but also a proactive, high quality customer service alongside strong security.

The Outcomes

Sage decided that ADP was the provider that best fitted their needs.

They chose to utilise ADP GlobalView in those countries where they employed a large amount of people, and ADP Celergo in the locations where they had fewer employees.

As the company is undertaking an ambitious merger and acquisition drive that’s likely to be long-term, the scalability of their chosen solution was key, and our payroll solutions at ADP can fulfil this by scaling to match employer needs.

Another benefit of ADP software is the ability to automate compliance with local payroll regulations. In those countries where Sage has a smaller workforce, they’re unlikely to employ payroll specialists. Therefore, the SaaS payroll can take care of this specialism, ensuring the company meets legal requirements while saving time and costs.

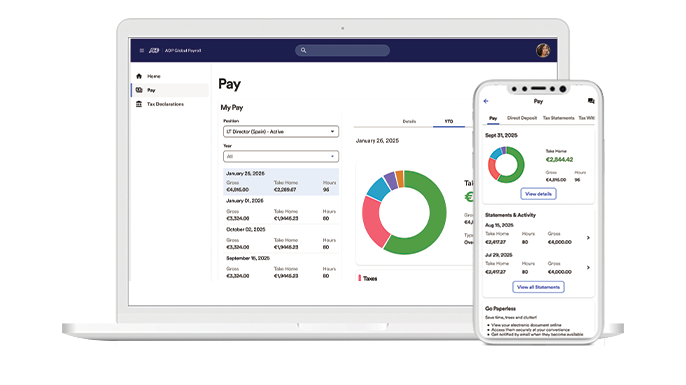

Both the ADP solutions employed by Sage, enable staff to log into a portal and access pay details and tax information. This was an important factor in helping get buy-in from stakeholders and proved very popular.

Within three years the transformation was complete, and Sage’s payroll has moved from multiple disparate in-house systems, to being fully integrated and managed by ADP.

"Data from payroll is valuable to any business. By working with ADP, Sage now has a more global strategic view of the organisation and an effective governance model. The team has been fantastic and a true partner to us in our payroll transformation journey.”

- Charlotte O’Driscoll, Global Payroll and People Projects Director, Sage

Learn more about

ADP’s SaaS software.

Schedule a customised demo

Call us at: 0800 1707 677

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.