Switch to payroll you can rely on from ADP

Save time and money by switching payroll providers to ADP. With over 75 years of experience, ADP delivers accurate, HMRC-compliant payroll and HR software and managed services to businesses of all sizes. Our expert teams will make your switch to ADP seamless, complete with flexible integrations and tailored solutions.

Why choose ADP as your new payroll provider?

If your payroll and HR teams are struggling with insufficient support from your current provider, it’s time to talk to us. We’ll help you reduce admin time, improve accuracy, and stay compliant through our cloud-based solutions.

Switching payroll providers needn’t be daunting. Our knowledgeable experts are on hand to help you make the transition and get you set up quickly.

Here’s why our UK clients stay with us 7 years on average

Excellent customer service

Offering technology expertise from over 3,000 HR and payroll specialists across 140+ countries, we give our clients an outstanding experience, from implementation onwards.

Easy integrations

Minimise risk with pre-built and custom ADP integrations. We ensure data flows seamlessly betweenyour payroll,HR, finance, and other critical business systems — including most ERPs.

Compliant payroll

ADP helps you reduce risk and stay HMRC-compliant with accurate PAYE/NIC calculations, automated RTI submissions, pension auto-enrolment, and end-to-end deductions and reporting.

Scalable solutions

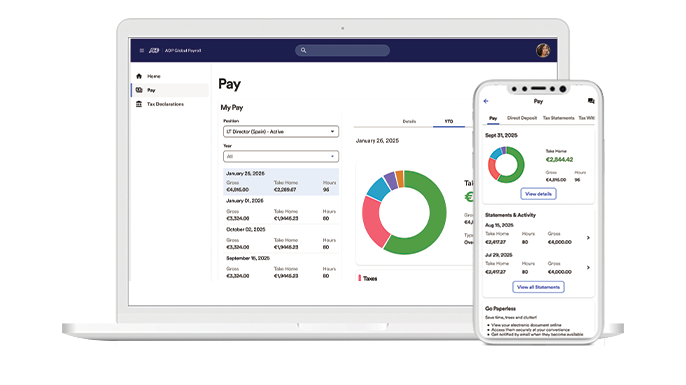

Our range of solutions grows with your business size and complexity. Choose from quick and easy payroll software to a full suite of HRand payroll solutions across multiple countries.

Don’t just take our word for it

Here’s what our clients say1…

95 percent said making the switch to ADP was easy

9 out of 10 agree that we help them comply with payroll tax laws and regulations

9 out of 10 now worry less about HR issues

Nearly 3 out of 4 say ADP is easier to use than their previous provider

Checklist for switching payroll companies

With the right support from a trusted provider, switching payroll companies is a lot simpler than it seems. Here’s what to consider before you switch, during onboarding, and while settling into your new relationship.

- 1- Understand your business needs

- 2- Schedule a demo

- 3- Prepare your data

- 4- Inform your employees

- 5- Complete the transition

Understand your business needs

Determine what benefits you want from a new payroll provider by asking these questions:

- Do we need payroll software or fully outsourced payroll administration

- What additional payroll features (flexible pay options, advanced analytics, API integration, etc.) do we need?

- What level of implementation support do we need?

- What ongoing customer service and technical support do we need?

- What software integrations do we need?

- Do we need a provider with international payroll expertise, either now or in the near future?

- Do we want employee self-service options, including mobile solutions?

Make sure you’re aware of the required notice period with your existing provider and factor in any termination clauses and fees.

Schedule a demo

Always explore demos with providers you are considering before committing to a new payroll provider. Demos make it much easier to establish if a certain provider is a good fit for your business — it’s an opportunity to see software in action and ask about SLAs, training options, and account teams.

Demos can also help you compare payroll providers.

Prepare your data

Once you’ve chosen your new provider, they will make it clear exactly what data they need from you to prepare a smooth transition. This will include:

- Company details and HMRC setup, including your organisation’s legal name, PAYE reference, BACS details.

- Pay schedules, includingcut-off dates, pay frequency, pay dates

- Employee information, including personal details, National Insurance numbers, start dates, bank account details

- Remuneration details, including salaries, bonuses and overtime, internal codes/cost centres.

- Compliance history, including current tax-year YTD figures, previous RTI submissions.

- Tax information, including tax codes, deductions, statutory payments, BiKs.

- Historical documents, including payslips, reports, P11D and P60 forms.

- Pension scheme details, includingaccount details, contribution structures, auto-enrolment assessment settings.

Inform your employees

Making sure your employees are kept updated throughout the process will help make the changeover process smoother. You will need to inform employees of any actions they may need to take, as well as how they will be able to access their pay information under the new system.

Complete the transition

Once you go live, it’s important to be vigilant during the first few weeks or months. Check calculations and payslips closely in the first few pay runs — your new provider should resolve any issues swiftly.

Regular reviews with your new outsourced payroll provider will ensure a successful, long-term relationship.

Reduce costs with ADP

If, like many businesses, your focus is saving money and time, then you’re in good company. An experienced, award-winning payroll provider like ADP can integrate your payroll and HR data into one cloud-based system that reduces manual processes. One workforce view means quick access to reliable payroll and HR data for more accurate, efficient forecasting.

ADP is always here to help

Our high levels of customer service are a combination of several factors:

- Delivering 24/7 support even outside normal business hours

- Constant monitoring of client accounts and data security by our 300+ security practitioners

- External assurance includes Sarbanes-Oxley guidelines and Payment Card Industry (PCI) Data Security Standards

- Saving your business time and helping you to boost efficiency through developing integrated, automated cloud solutions.

Future-proof your business

We work with organisations with a variety of head counts, providing managed and processing services and payroll solutions across a range of sectors, such as manufacturing, retail and financial services.

Our cloud-based solutions help you future-proof your business, so that you can respond quickly to unforeseen events and use data analytics to pivot your strategies as and when needed.

Plus, our payroll services evolve with you. We offer more options than most other providers, as we’ve been living and breathing payroll for 75 years. Over one million customers globally trust us to deliver and support cloud payroll processes.

What people say about our payroll solutions

The ADP implementation process was incredibly smooth and professional. The support team has been fantastic, and the quick response times have made all the difference. We feel more secure knowing we have a partner who understands the importance of payroll accuracy and employee satisfaction.

Sara Quinn Payroll Manager, Next 15

Support is the best, the service team is responsive, it does exactly what it says on the tin.

Jalen Davis Management Accountant, Simba

In choosing our solution we wanted to go with an organisation that was credible. One in six people pay through ADP so it's a massive organisation. But you don't feel like you're dealing with a huge organisation. You feel like you're dealing with a local partner.

Lee McQueen Managing Director, Raw Talent Academy

Top FAQs about switching

How much time will it take to switch to ADP?

The time it takes to switch depends on your company’s priorities, the services you’re currently using and how quickly you can access the necessary data. Some of our customers are up and running in two days, while others choose to switch over within weeks. Some non-payroll services may take longer to set up. However, we ensure that all transitions are well-planned so as not to disrupt your payroll process.

When is the best time for switching payroll providers?

We can support your move at any time. Some customers prefer to wait until a new quarter or new tax year, to reduce the amount of data that needs to be transferred and managed between providers. However, if you choose a reputable provider and keep HMRC updated, a smooth transition can easily be achieved mid-year.

How much does it cost to switch to ADP?

Certain factors will affect the cost of payroll, such as pay frequency, the number of staff you pay, how often you add or remove payees, and which services are needed. We’ll work with you to determine the right payroll package for your size of business, no matter how simple or complex your objectives.

How do I pay employees if disaster strikes?

Our products are in the cloud, which means you can run payroll anytime, anywhere – regardless of what’s going on locally. We have an established Business Resiliency Plan to enable us to respond to any incident including partnerships with local and international agencies, planning for employee safety and the swift recovery of essential data centre operations.

Why do organisations change payroll providers?

There are many reasons why businesses choose to switch from one payroll company to another, from changing organisational needs to issues with the current provider. In general, businesses want to save time, reduce errors, and lower risk.

Here are some common reasons for switching provider:

- The existing provider is not using up-to-date payroll technology, such as cloud-based software and AI integrations

- The budget, scope, needs, or structure of the business has changed

- The current provider is unreliable, demonstrating consistent compliance or technical issues

- The current provider doesn’t provide effective integrations with other business-critical software,

- The new provider provides more transparency around fees and scope

- The business wants to consolidate payroll and HR services into a single provider.

2 ADP 2020 Client Survey.

3 ADP 2020 Client Survey.

4 ADP 2020 Client Survey.

5 G2 user review data from March 23, 2022.

Let's find the perfect solution for your business

Call us at: 0800 1707 677

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.