ADP International Managed Services (IMS)

If you’re leading a small team from a multinational business that’s new to the UK, the last thing you want to have to worry about is paying your people accurately, on time and in compliance with the country’s complex payroll regulations.

Relax. Let ADP IMS take the pressure of payroll off you

IMS is a comprehensive, fully-managed payroll service. It’s provided by ADP in the UK to small subsidiaries of multinational companies who have little or no experience of working in the country but want to establish a presence there.

ADP IMS is perfect for businesses with between one and 30 employees. It delivers all the payroll you need, all in one place, but without all the hassle.

ADP IMS will do all the hard work for you …

Pay your people accurately and on time, every time, keeping your team happy and engaged

Process the payments to all the required statutory bodies, such as His Majesty's Revenue & Customs (HMRC), so you don’t have to

Ensure your payroll is compliant with all the UK’s rules and regulations.

All you need to do is let us know of any changes to your payroll — such as new hires or salary changes. This is easily done monthly, via our secure online portal.

The benefits of doing business with ADP IMS

- Easy set-up — fast, simple and convenient

- Save time, money and effort — a dedicated payroll team and service when you can’t justify the cost or headcount

- Peace of mind — your people paid the right amount, on time, every time

- Stress-free — removes the worry of compliance with the UK’s payroll regulations

- Maintain focus — you concentrate on core business tasks, we’ll pay and liaise with the statutory authorities

- Keep control — full visibility at all times and at every stage

- Safe and secure — industry-leading data security and privacy

- Total flexibility — payroll that can scale and evolve as your business does

- Regular reporting — to help you make better informed business decisions

What’s included

- Pension regulations — auto-enrollment managed

- National Insurance Contributions (NIC) — calculated and paid

- Payroll-related leave and absence management — including maternity, paternity and sickness

- Recognised by HMRC and regulated by the Financial Conduct Authority (FCA)

It’s easy to make ADP IMS work for your business

ADP:

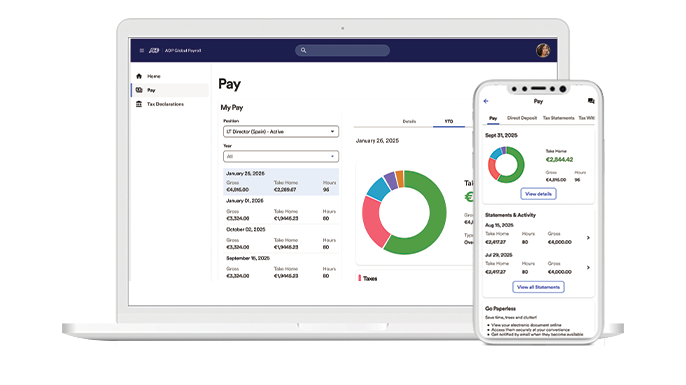

- Runs payroll for you through our secure, state-of-the-art payroll system

- Takes responsibility for compliance with the UK’s laws and regulations

- Exchanges all the necessary data and payment information with the tax authorities, mandatory third parties and statutory bodies

- Provides you with your payroll results and documents, like pay slips for your employees, via a secure online platform

- Gives your employees easy access to their pay information via a secure employee self-service portal, where they can download their pay slips and year-end-statements

Managing payroll abroad

The problems are complex …

If you’re going for global growth, we understand how the challenges of running payroll abroad can hinder your expansion plans — and moving into the UK is no different.

These challenges range from a lack of understanding of the local regulations (and staying compliant with them) to language, cultural and bureaucratic barriers as well as having to deal with the mandatory public institutions, such as the tax authorities.

The solution is simple …

Let ADP IMS manage and run your entire payroll for you, while you focus on core business tasks.

Contact us

Find out more about the business benefits

of ADP IMS

Simply complete our enquiry form or call us on the number below.

Call us at: 0800 1707 677

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.

This service is ONLY available for businesses.

We are unable to provide individual background checks.

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.