Payroll Management Systems

Payroll management systems automate and streamline your entire payroll process — from recording pay and calculating deductions to creating payslips and paying HMRC.

Trusted by more than 1 million clients worldwide, ADP payroll management software saves businesses time, reduces errors and makes compliance easy.

Benefits of using a payroll management system

All UK employers must maintain accurate payroll processes. Without an appropriate system, however, many find it challenging and time-consuming to handle internally.

Using a payroll management system can therefore help companies free up more time to focus on growing their business.

Here’s are some of the main benefits of payroll management software:

Streamline payroll processes

- Automates repetitive tasks like PAYE calculations and National Insurance Contributions (NICs)

- Integrates with HMRC systems for seamless and accurate reporting, including Real Time Information (RTI)

- Integrates with HR and time-tracking systems to connect data and make processes more efficient

Improve reporting accuracy

- Centralises employee data, making it faster and easier to accurately carry out payroll processes

- Reduces errors by automatically applying the correct tax codes, thresholds and student loan deductions

- Generates payroll and HMRC reports for real-time insights and compliance with all legal requirements

Improve cost efficiency

- Lightens the workload of HR and finance teams by automating complex and time-consuming payroll tasks

- Lowers the risk of HMRC penalties for errors, inaccuracies or late filings

- Improves cash flow management by forecasting payroll costs and employer contributions more accurately

Access compliance support

- Automatically updates with the latest HMRC rules, tax bands and National Minimum Wage rates

- Keeps compliant records, simplifying tax compliance checks and payroll forms, including P60s and P45s.

- Ensures consistent compliance with UK employment legislation, including employee classifications

ADP helps FedEx deliver smoother payroll

With operations in over 220 counties and more than 490,000 employees, FedEx needed a payroll system that could meet the company’s global scale and complex demands.

The company previously ran over more than 68 different tools and a staggering 60% of employees had no access to a digital attendance system.

FedEx therefore decided to implement to streamline all its payroll processes around the world.

After implementing ADP’s payroll management system, FedEx’s payroll processes now run like clockwork and all payroll teams are on the same wavelength.

“With ADP’s Global Payroll I can now check which country’s payroll is on time and if any have missed their cut off dates, so I don’t have to request information from different payroll teams. We now have international ownership and one system to gather information with all data in the same format. And in addition, the standardised systems allow us to apply a set of standardised controls as well.”

- Natascha Moore, International Payroll Manager and Global Process Owner Payroll FedEx

How to choose the right payroll management software

Payroll management software can help reduce errors in your payroll cycle by automating PAYE, RTI submissions, and National Insurance and pension calculations. The right solution should integrate seamlessly with your HR and accounting systems and provide automatic HMRC and compliance updates.

Learn more about ADP payroll management systems

Get in touch to find out how our payroll management systems can help your company cut payroll processing times, reduce errors and keep you compliant.

Payroll manager software options

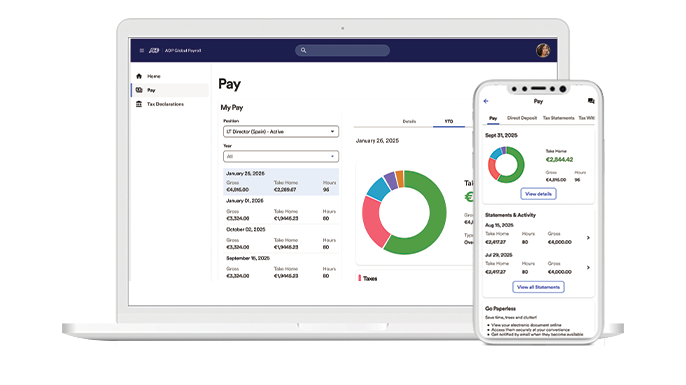

- ADP Global Payroll: our centralised cloud platform that consolidates multi‑country payroll cycles and local compliance rules. Perfect for multinational organisations that need a single view of global payroll and local legal compliance.

- ADP Enterprise Payroll: our scalable payroll system designed for large UK employers with complex pay rules, multi‑company structures and high transaction volumes. Ideal for companies that need more customisation options, integrations and dedicated support.

- ADP iHCM: our integrated human capital management suite that brings payroll, HR, talent and workforce analytics together in a single platform. Ideal for businesses looking to enhance their HR and payroll experience with self‑service, time-tracking and people‑management tools.

- ADP Managed Services: our hybrid option that pairs ADP technology with outsourced payroll processing and expert support for both compliance and day‑to‑day operations. Recommended for businesses that want to retain strategic control while offloading admin tasks.

FAQs

What are the different types of payroll management?

Companies can manage their payroll either in-house manually or with software, outsource it to a payroll service provider or use a cloud platform that combines payroll with HR services. Hybrid approaches mix internal workflows with outsourced tasks and cloud tools.

Which software is used for payroll management?

Businesses use specialist payroll management software, accounting-integrated solutions and enterprise HR platforms, depending on their size and needs. Employers should aim to choose software that integrates with their existing systems and offers the features and security they need.

Schedule a customised demo

Call us at: 0800 1707 677

By submitting this form you are informed that ADP may contact you about its products, services, and offers, according to our Privacy statement for Business contacts.

Let's find the perfect solution for your business

Fill out the form and see what the ADP team of payroll and HR experts can do for you.

Resources & Insights

With over 75 years of payroll expertise and innovation, ADP provides data-driven insights and expert resources to help payroll teams stay compliant and confident.

insight

How to manage multicountry payroll

insight

How to set up a payroll system for a small business

insight